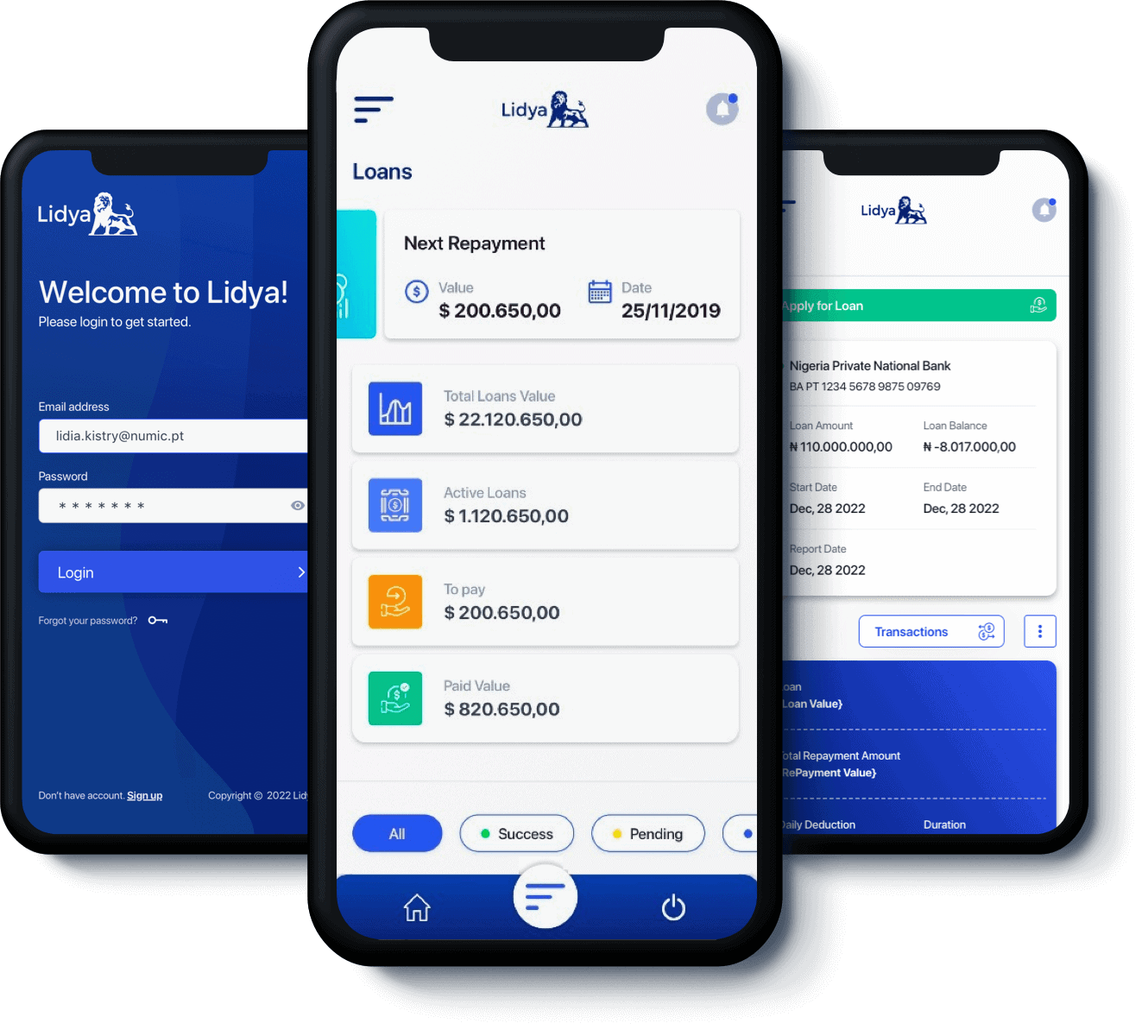

The constant view and assessment of transaction activity in customer accounts will allow Lidya to give you same-day credit. No paperwork needed, no collateral, the simplest process it could be to help you meet your targets, increase your sales and grow your business.

By using Lidya’s Platform you will take part of Lidya’s Score system that will open the door to better Loan Terms: better interest rates, better repayment options, longer tenor loans, Larger loan amounts.

You can get a Lidya POS, and receive your payments in real-time instead of waiting at least one working day. You can also perform all your transactions and receive money into your Lidya accounts for free.

Real-Time projections for your business based on your accounts data. Access the dashboard with all your transactions and projections for cash balance, revenue and payouts over the next 3 months.

Our technology is built to be scalable, flexible, and customizable to meet the unique needs of each client.

Our team of experts has extensive experience in the lending industry, and is dedicated to providing top-notch support and service to our clients.

We are committed to ethical and responsible lending practices, and to promoting financial inclusion and economic growth in Africa.

In today's digital age, it's surprising to learn that some lenders are still relying on paper applications and mandates to assess loan applications. Don't get left behind with outdated processes - choose a lender that values speed, efficiency, and convenience.

Say goodbye to the headache of inaccurate reporting and missed deadlines. Our platform offers lenders detailed and precise reporting, empowering them to close their books on time with confidence and ease.

Our team of experts will guide you through the onboarding process. You will be able to understand the end-to-end solution and how it fits your needs.

Together we will set-up the solution to fit your brand and lending processes.

We have digital solutions for you to digitize your entire lending process from customer acquisition to collections.

100% Digital

Bank Information Assessment

Powerful Algorithm

Acquire Customers

Adapted to your Processes

Reduce Risk