Lydia is doing great job in helping businesses and I’m one of those that has been benefiting from the great services Lydia is rendering

Stoprite Stores

Automate Collections

Don’t waste time on collections processes by implementing Lidya’s automated direct debit mandate for collections.

Get Paid. Faster

To grow your revenue, the first step is to make sure you get paid. The second step is to make sure you get paid on the date you are expecting with no delays.

Simplify Payments

Provide a better payment experience for customers with simple and frictionless process.

Multiple Account Collections

With Lidya Collect you are able to collect with direct debit mandate, not only from one account, but from all the accounts of your customers who owe you payments.

Powerful Cashflow Management

Make sure your business is always healthy by having the cashflow you need, collecting from your customers automatically. View and manage receivables at one place.

Team Management

With Lidya Collect, you will free up your human resources, reducing the dependence and workload from your accounting department.

Of Lidya Customers Say Collections Are Somewhat Or Very Painful Or Challenging.

Saved a month

36% of SMEs say it will improve business efficiency

Faster to collect.

Based on 2022 Lidya Survey.

Place A Direct Debit Mandate On The Account Of A Customer And Automate Collections.

Create repayment plans that cover multi bank accounts from clients.

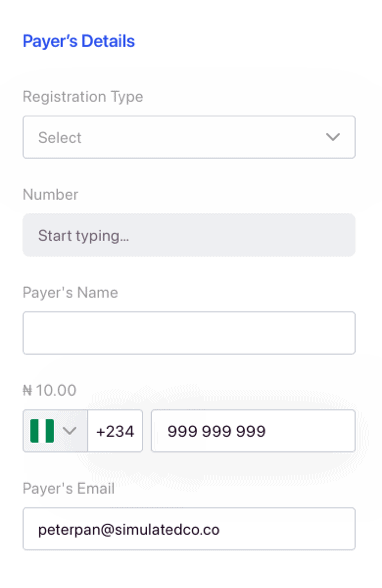

Identify payer by BVN

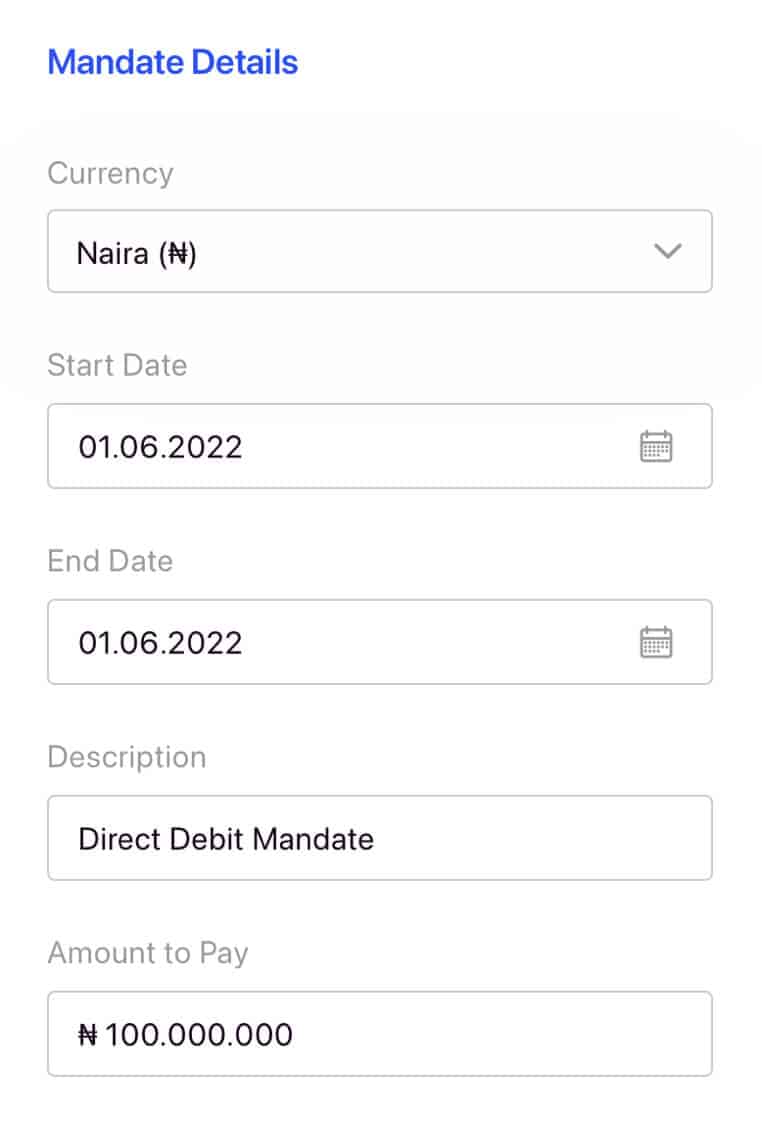

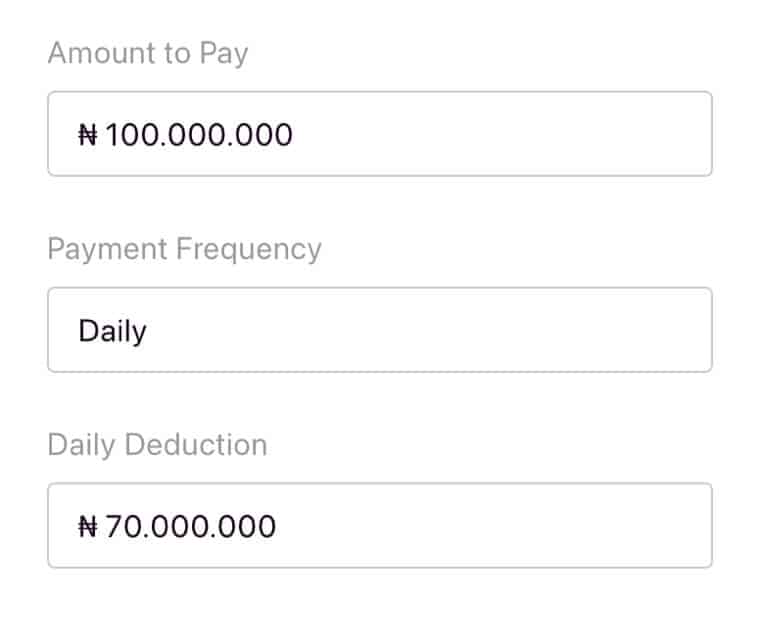

Define amount to Collect

Define Collection Frequency

Manage your authorizations

Lydia is doing great job in helping businesses and I’m one of those that has been benefiting from the great services Lydia is rendering

Stoprite Stores

So far so good. Everything is online now. Is okay.

CHIMA UKO

Very good,and it's the best platform ever

Michael Obiene

Lydia remains the best in terms of customer services

Echeme Peter

Lidya Collect allows business owners to digitally automate and enhance their customer repayments and debtor funds recovery with standing instructions. It accelerates growth by freeing up their resources, improving their cash flow, and increasing revenue and business margins, as the customer repayment plans cover multiple banks and are paid directly into their Lidya Wallet

Every day businesses undertake the hassle of repetitious, mundane, manual payment collections that eat up employee time. Make the single biggest process improvement to accelerate your business by automating the collections of your accounts receivable (A/R) and enhancing funds recovery. Lidya Collect allows you to free up your resources as you create and manage automated collections, and improve your cash flow, revenue and business margins seamlessly.

With Lidya Collect you can accelerate your business growth by automating the collections of your accounts receivable (A/R) and enhancing your debtor funds recovery. Lidya Collect allows you to:

Improve your cash flow position

Increase your revenue

Increase your business margins

Free up your resources

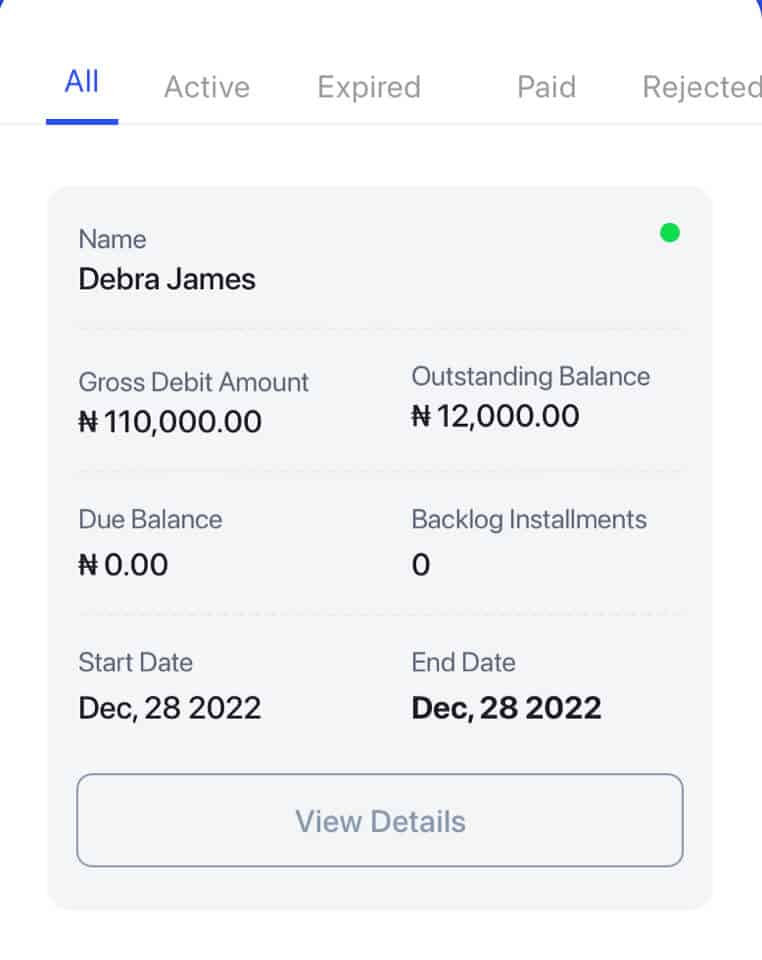

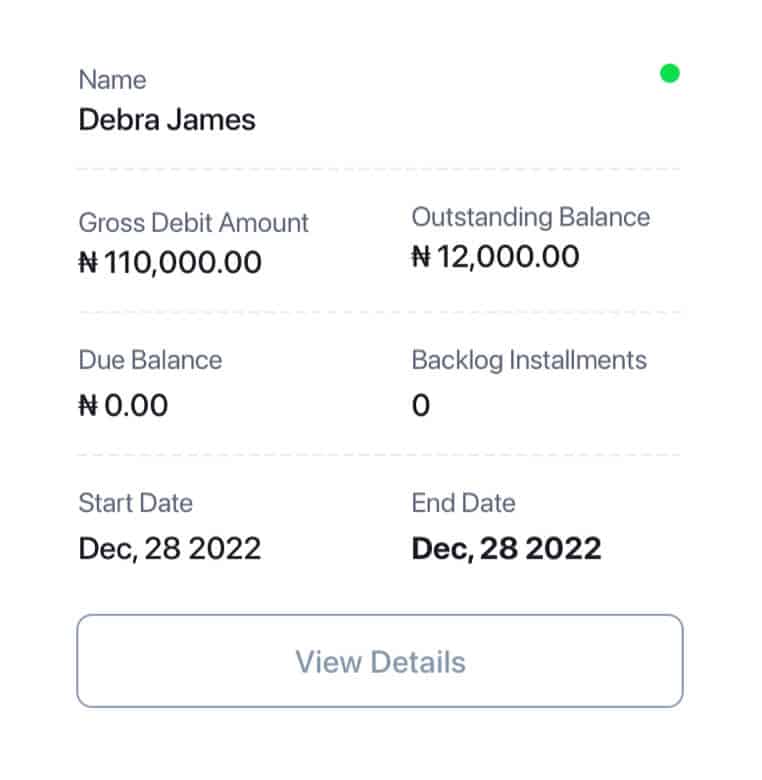

Lidya Collect helps to automate all your customer collections and debtor fund recovery. It sets up a standing instruction with a payment mandate which the payer must accept to enable you to connect to their bank account to seamlessly collect your payments. Lidya Collect allows you to monitor all active, deactivated or expired mandates and payments.

To automate all your customer collections and fund recovery with Lidya Collect, simply create and monitor your automated collections by:

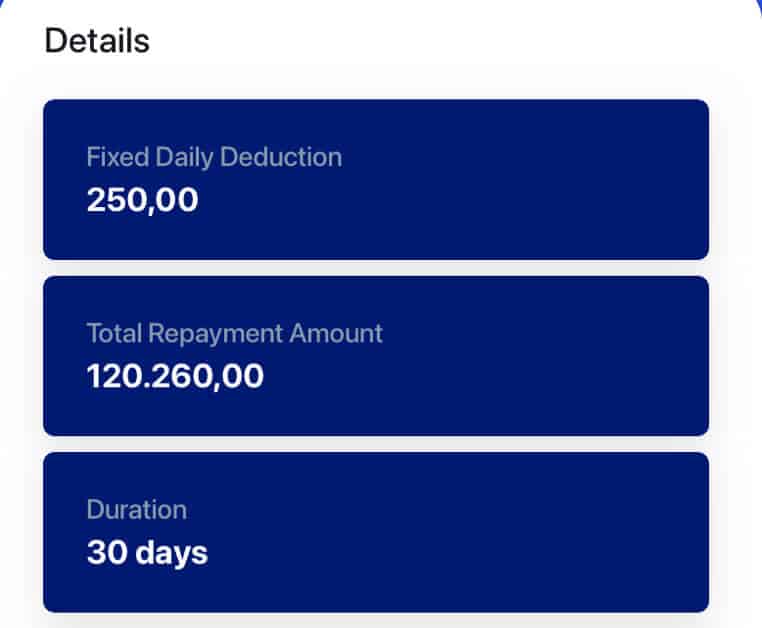

Going to the Collect tab, select create to set up the payment mandate plan details with a clear description, amount, currency, collection frequency and start date

Add all the payer details and connect the payer by BVN

Select Validate to ensure the details are accurate then submit to send to the payer

The payer will receive the mandate via email and can authorize or reject the mandate

Once signed it is authorized and moved to the active position where you can monitor your collection status

You can monitor what is paid, view expired mandates and also deactivate mandates

To complete the onboarding you will need to submit: 1) Certificate of incorporation 2) CAC 2 3) CAC 7 4) BVN number

For the demo period, we suggest using the existing tool. The API integration is a custom solution that can be invested in once you have enjoyed the benefits of our service.

We are limited to banks that NIBSS provides. However, NIBBS covers all the Nigerian commercial banks, and we can share a complete list.

Not at the moment. By design, the accounts are added to the Collect in the order they are found from the linked BVN.

Collect will start using the first account. If it fails after the four attempts, it will switch to the second account.

Only when the second account fails, it will switch to the third account, and so on until it reaches the last account.

If the last account fails, it will start again from account 1

We collect 4 times a day, always starting with the primary

Not at present; as discussed for the demo period, we suggest using the existing platform, and the necessary tools can be discussed at a later date