The loan services are beyond first-class, response time is second to none in the industry.

Ilonwa Peter

Helping our customers collect payments digitally.

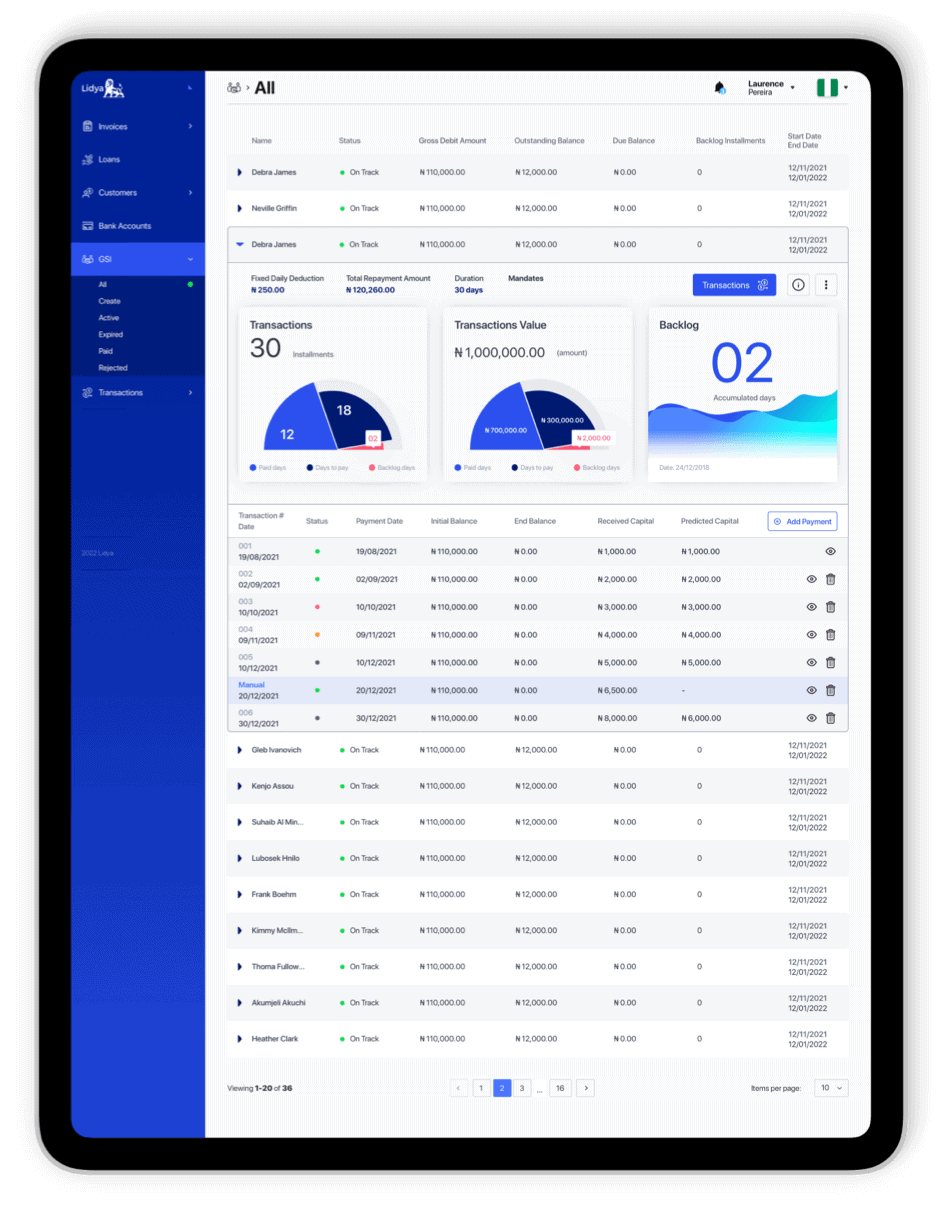

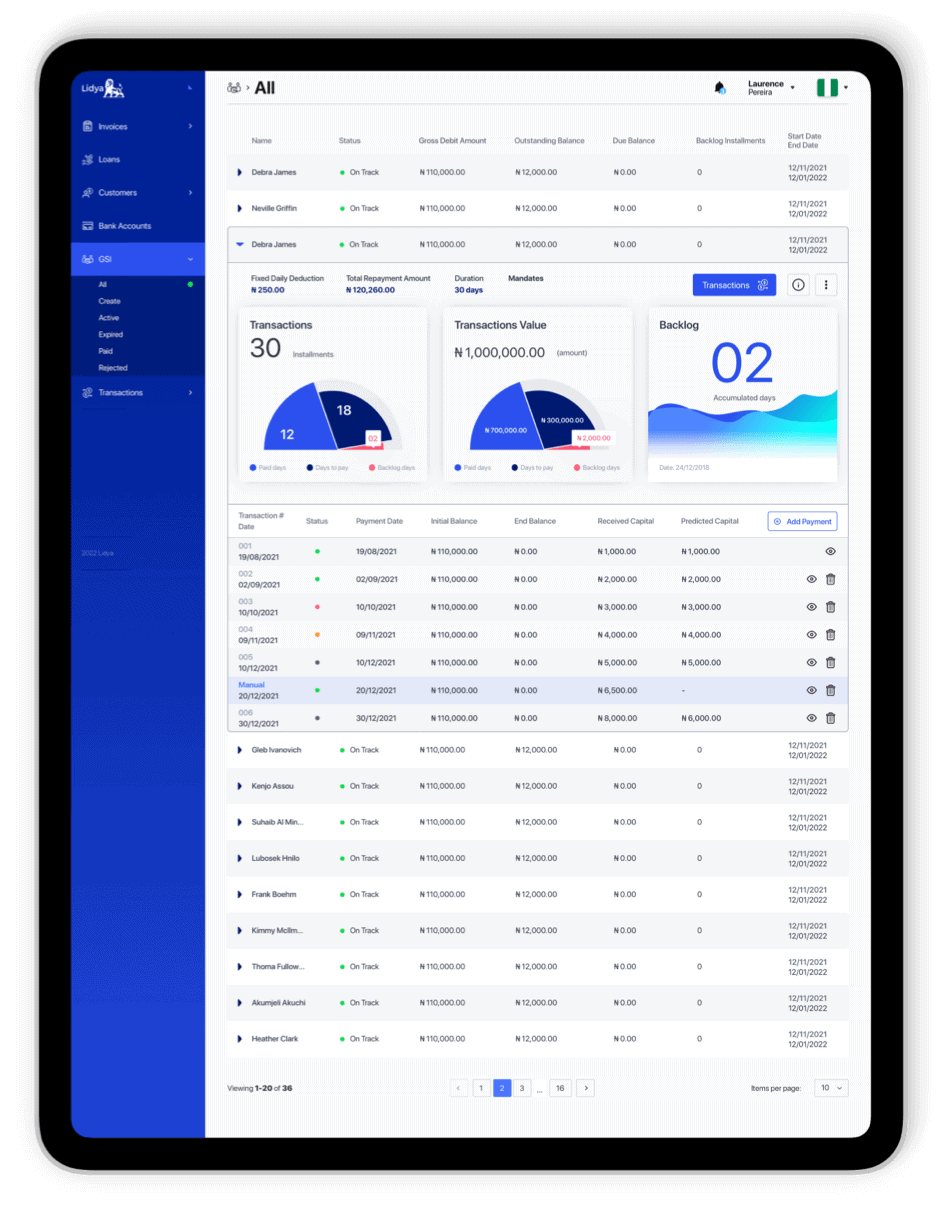

A flexible solution that digitizes your loan processes.

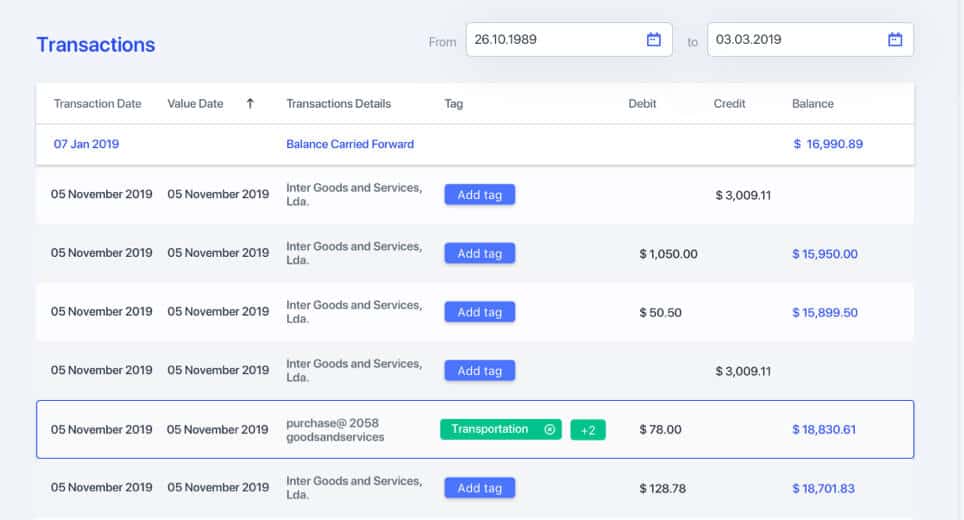

Helping our customers accept digital payments.

Transfer money to any account instantly.

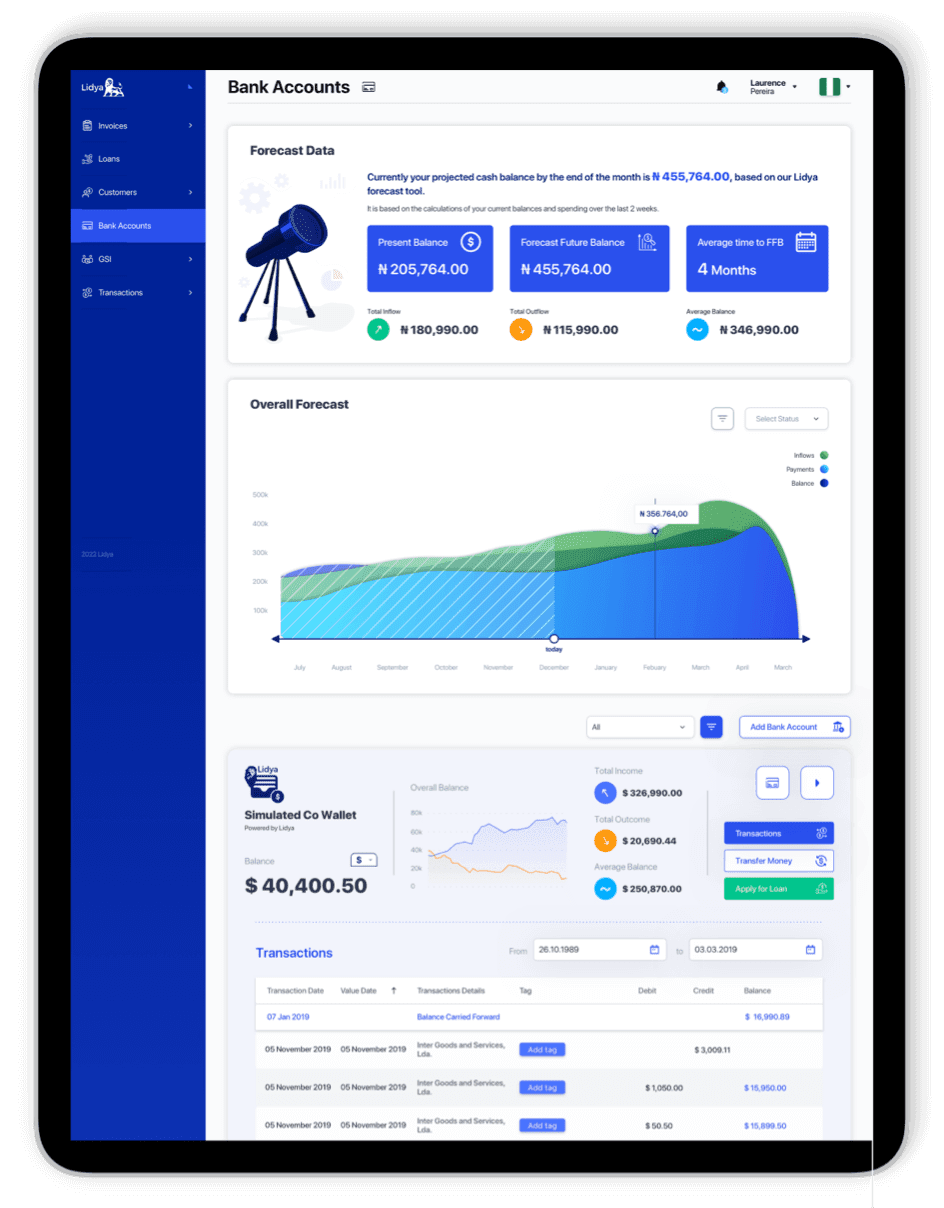

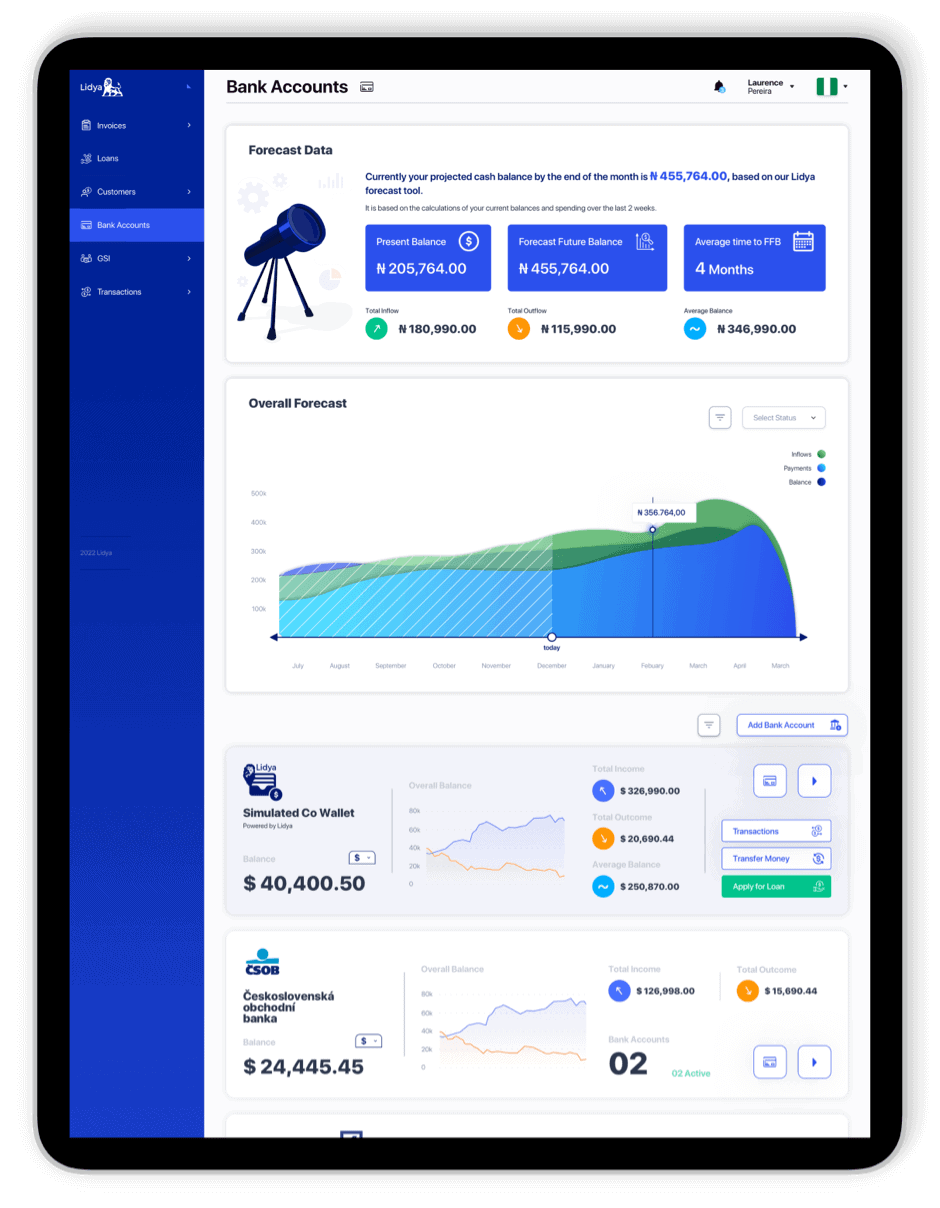

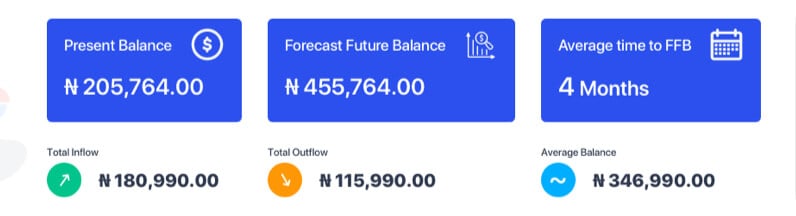

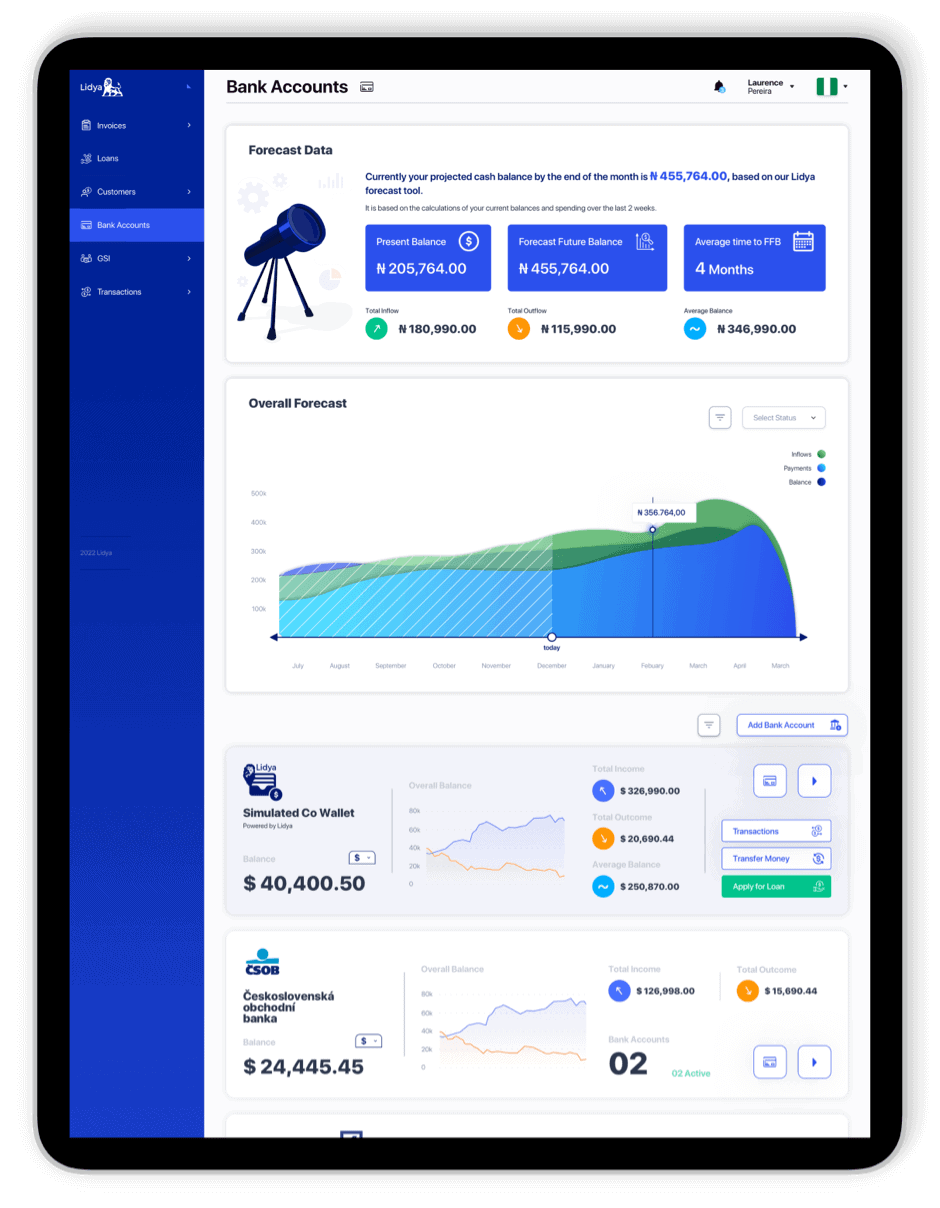

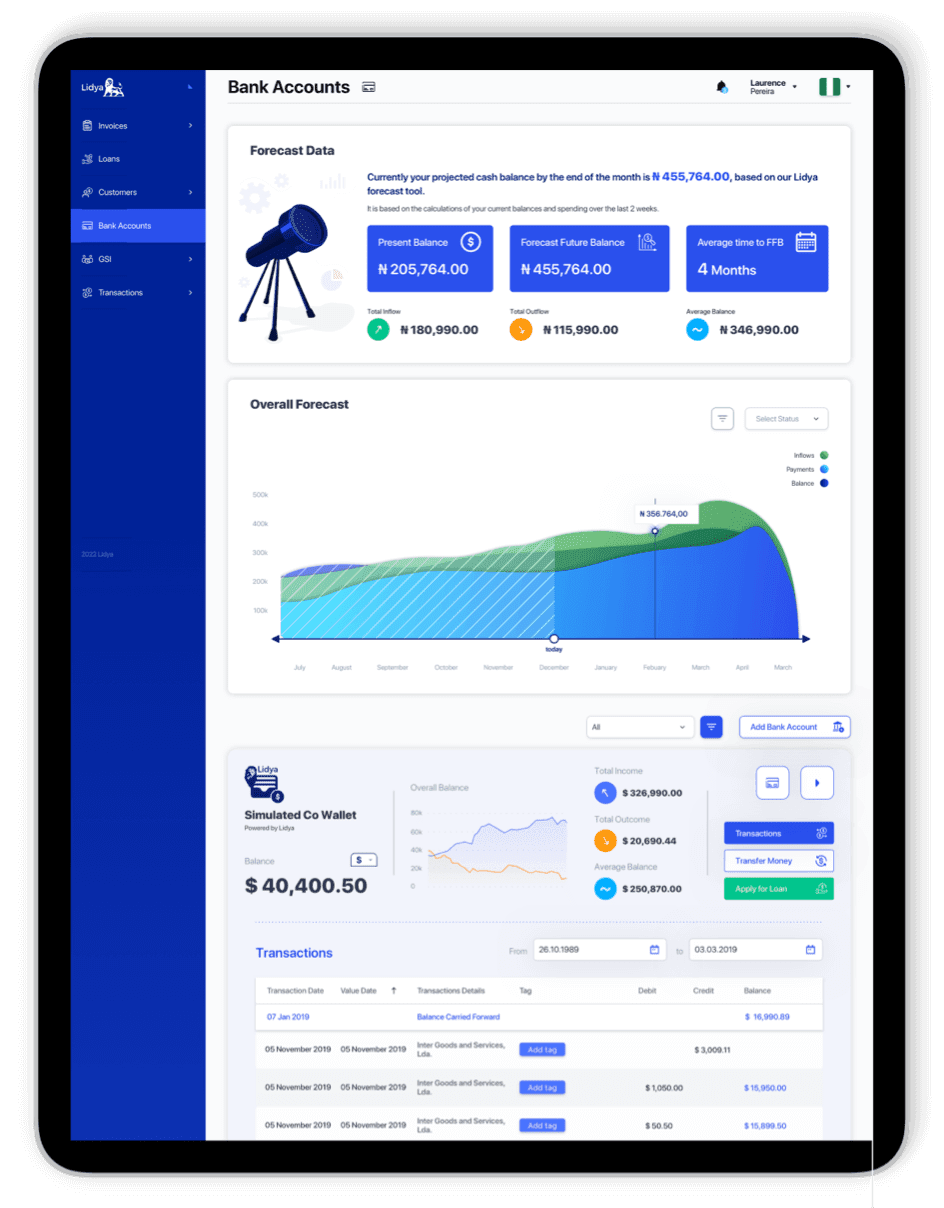

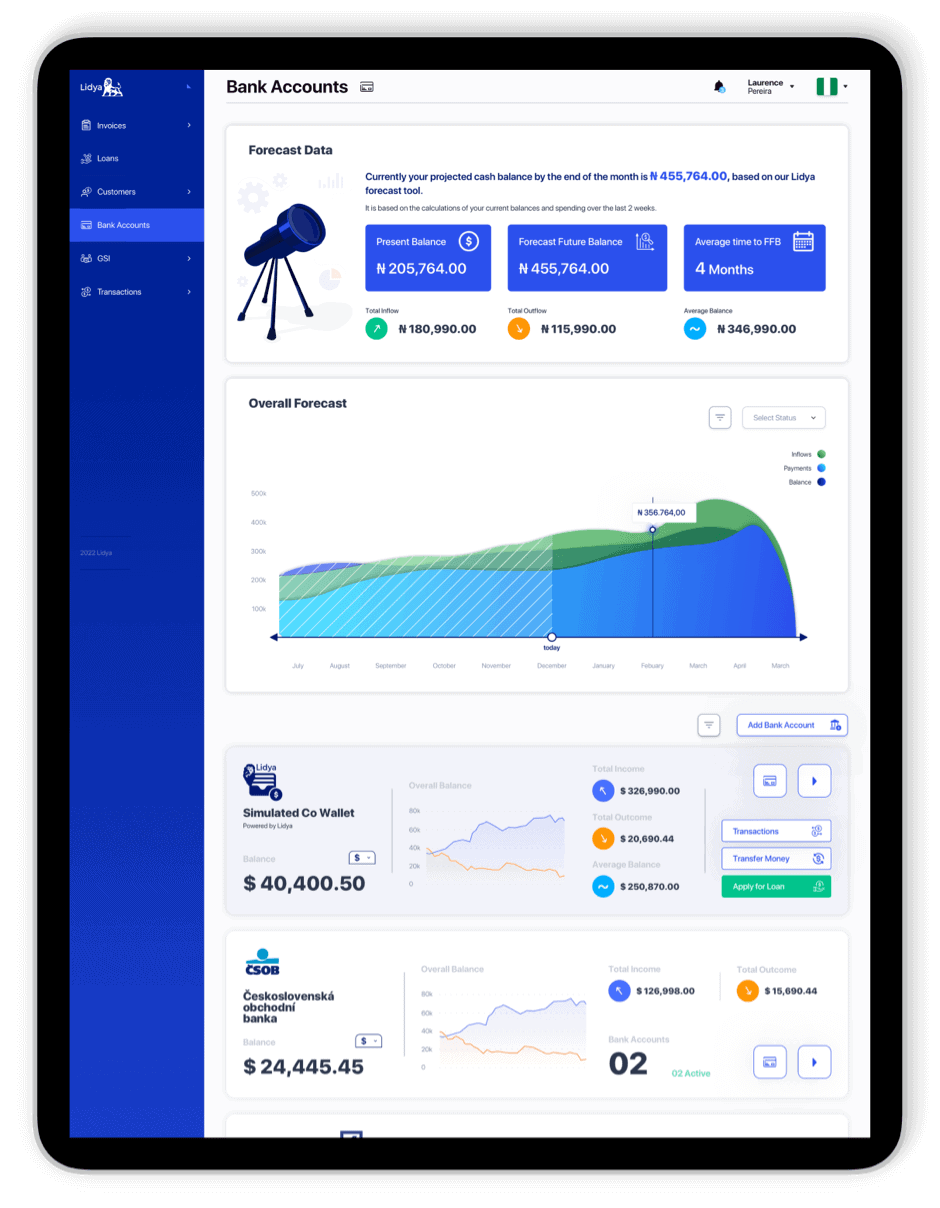

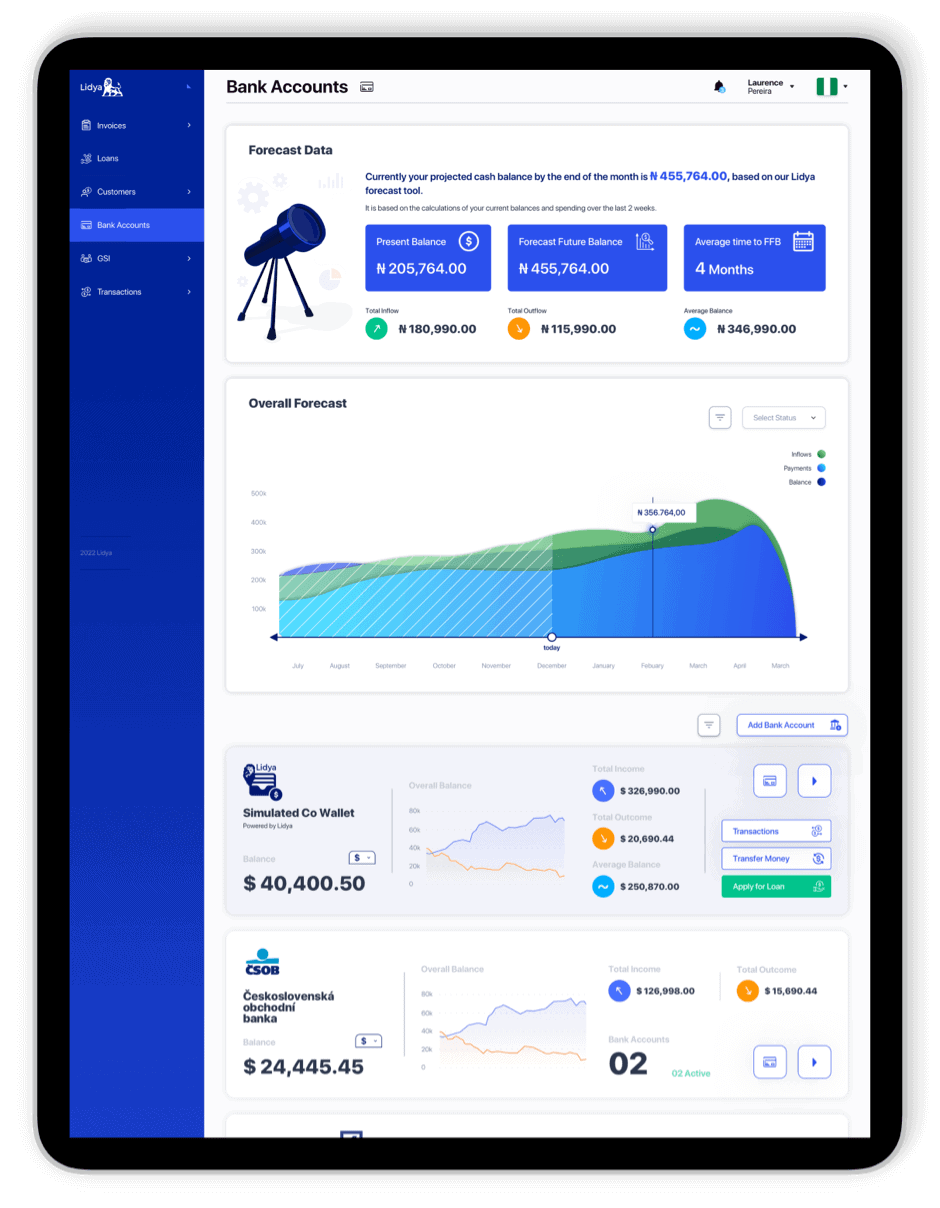

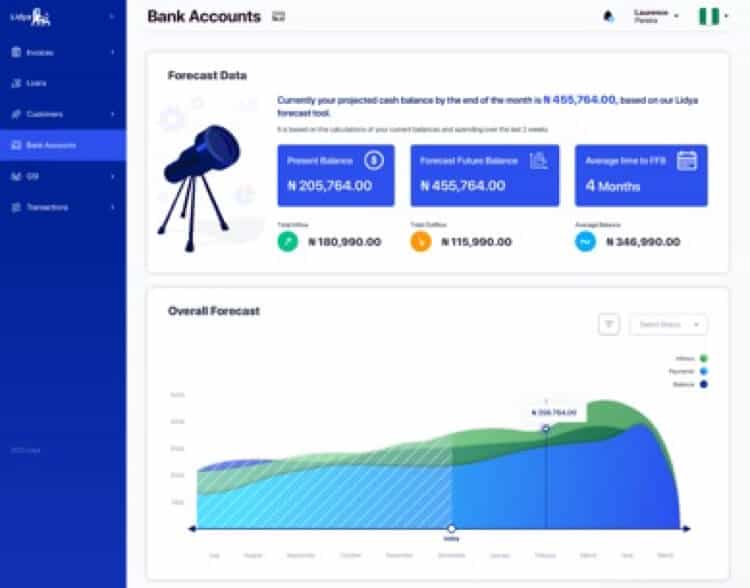

Plan your business with Lidya Forecast in one single view.

Credit Providers can drive digital credit revenue and margin today through our customer acqusition and collection tools

Join the biggest companies in Nigeria using this solution and create customer repayment plans that cover multiple banks digitally.

You can acquire customers, originate loans, collect repayments and manage your portfolio, at the best rates.

We are experts in digital lending. We have digitized and analyzed over US $50 Billion worth of credit application data from 100k customers, issued ~ 32,500 loans and have powered close to $150m in loan disbursements.

Place A Direct Debit Mandate On The Account Of A Customer And Automate Collections.

Learn Moreabout Lidya CollectSend Money And Receive Money Through Your Lidya Wallet

Learn Moreabout Lidya TreasuryOne Dashboard With All Your Transactions And Projections.

Learn Moreabout Lidya Forecast

Place A Direct Debit Mandate On The Account Of A Customer And Automate Collections.

Learn More about Lidya Collect

Send Money And Receive Money Through Your Lidya Wallet

Learn More about Lidya Treasury

One Dashboard With All Your Transactions And Projections.

Learn More about Lidya Forecast

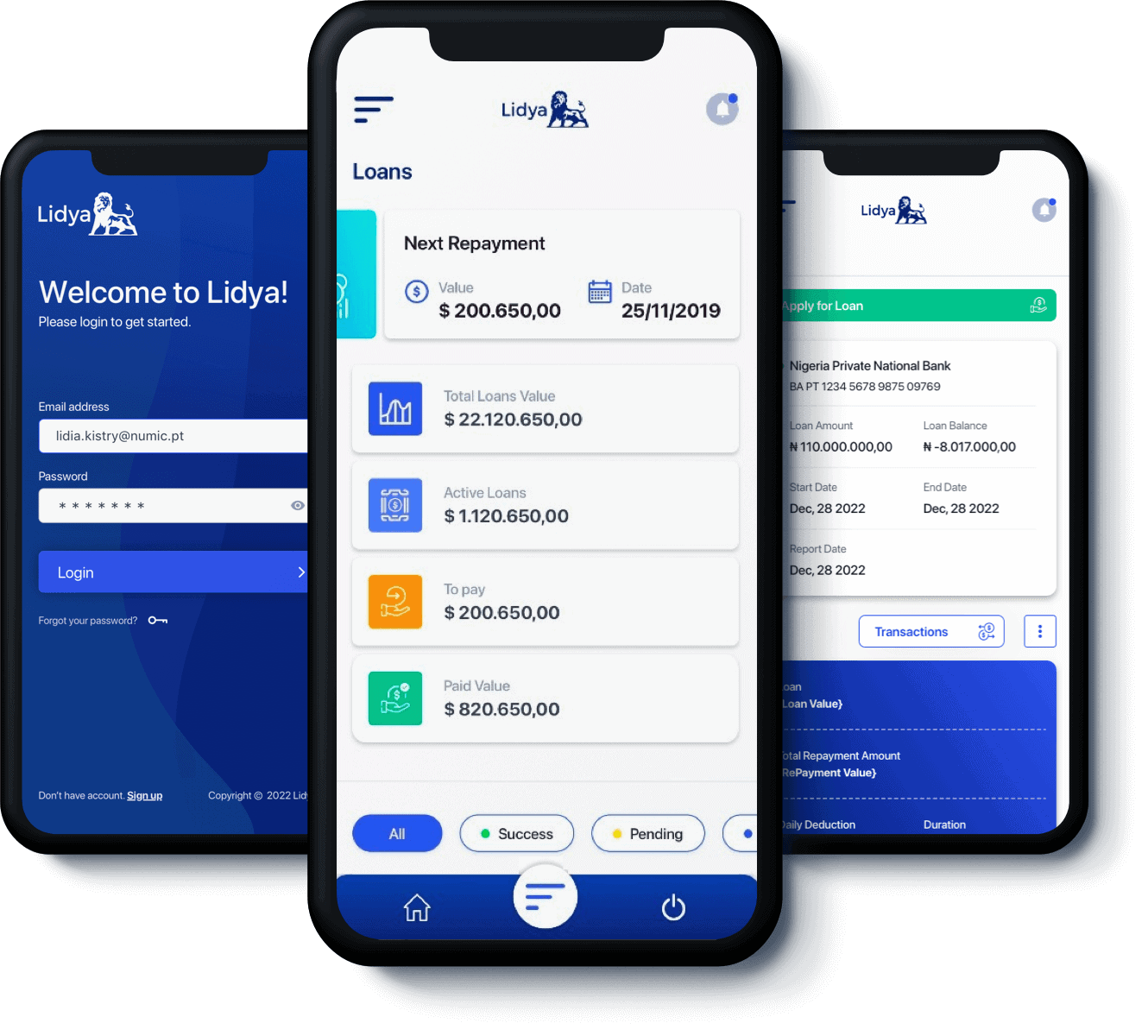

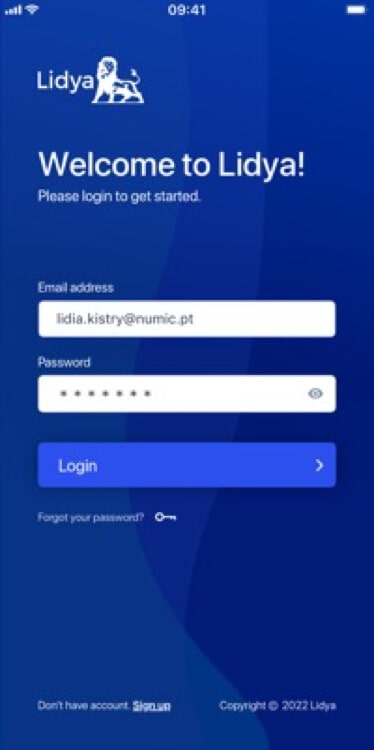

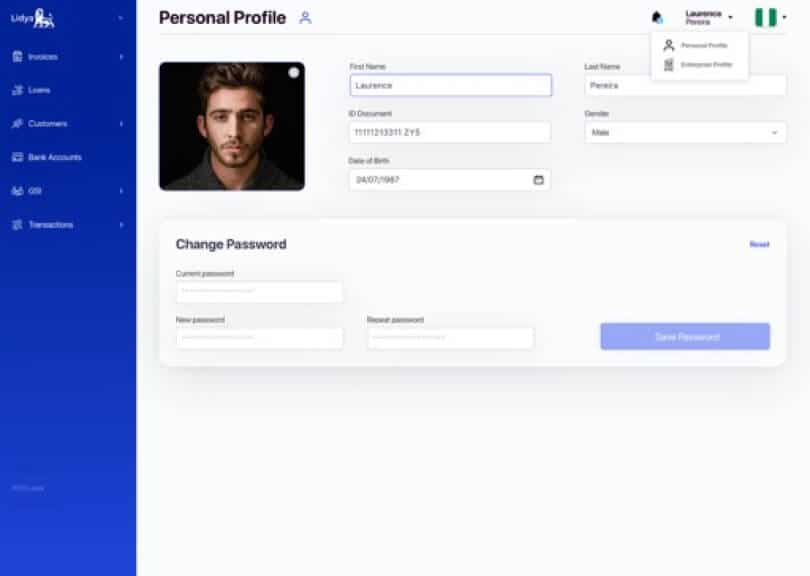

Create your business profile and roles so you and your team can access Finance-on-Demand.

By submitting your bank statements or by connecting your bank account, you can securely connect your data and simply access Finance-on-Demand.

Start automating your collections, set your digital payments and access your loans in 48h*.

SME business owners look to Lidya to outgrow and improve on the established and unbalanced conditions tied to the financial services industry. Fees, time, cumbersome processes and lack of data are always on top of mind.

*2021 Lidya’s Customer Survey Results

Our platform is safe and secure and protects your data from any security breaches.

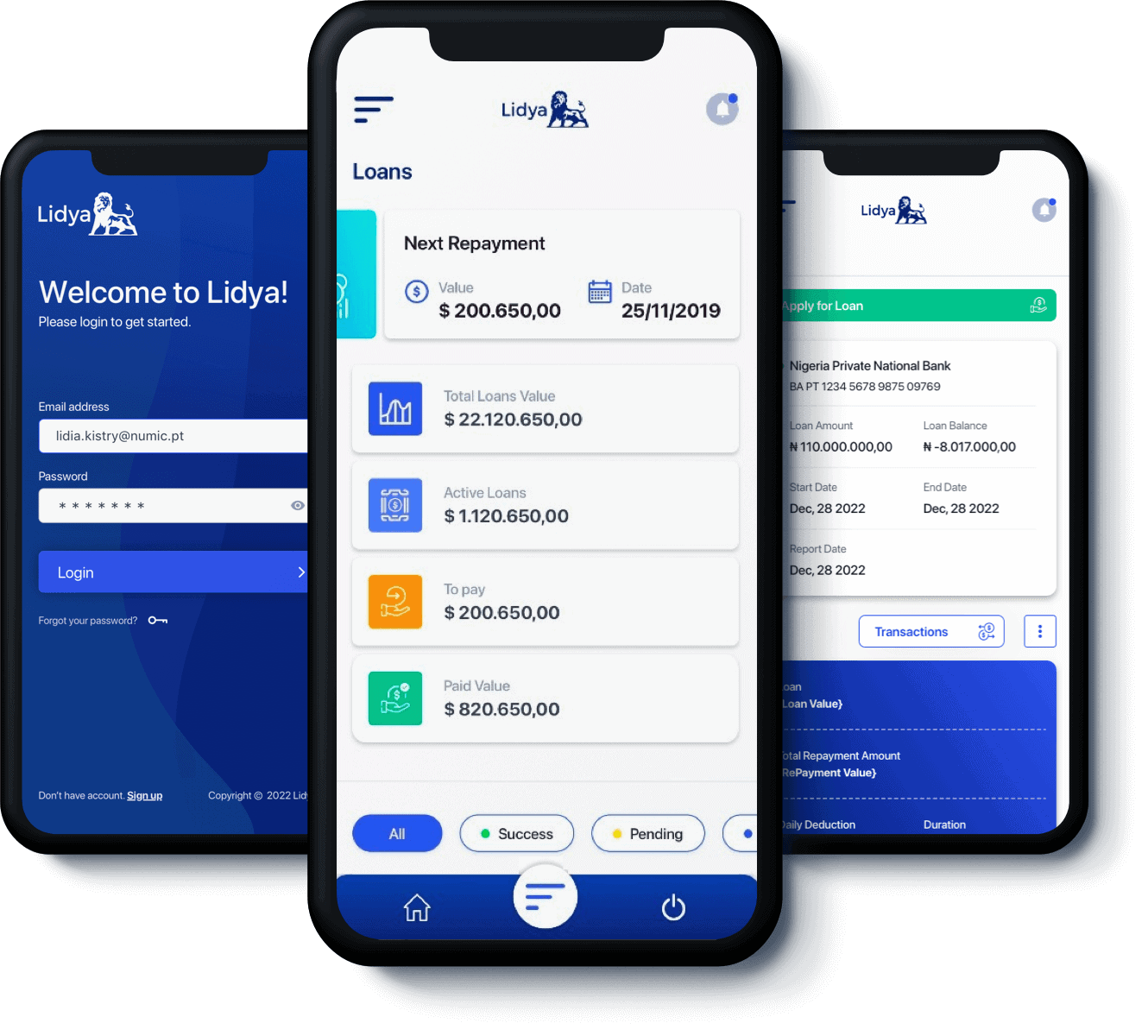

You are able to apply to and manage your loans in real-time in Lidya App.

SME business owners look to Lidya to outgrow and improve on the established and unbalanced conditions tied to the financial services industry. Fees, time, cumbersome processes and lack of data are always on top of mind.

The loan services are beyond first-class, response time is second to none in the industry.

Ilonwa Peter

Lidya financing was a life saver for our business. Processing was Swift and repayment quite convenient.

Adebayo Azeez

The support of our Bakery Business through financing over the last two years has been enormous and impactful. The support had enabled us to increase our production capacity in terms of buying raw materials needed for production

Ayobami Ogunkeye

I give lidya a five star they have been supporting my business for about three years now and they have been wonderful even when we have issues we could always resolve it amicably.

Dunican Okon

Lidya's next-generation finance platform brings our customers a host of credit, payments, treasury and forecasting solutions in one single place. It helps businesses take advantage of their business growth, data and insights to unlock better credit offers, and save on payment fees, while managing their business success in real-time; making it easier to access Finance-on-Demand with one-click access.

Learn More Learn More

Many small businesses struggle to get access to finance, finance at the amount that is needed, with their preferable terms. With Lidya Finance-on-Demand, customers can: Save time on tedious financial tasks with all accounts in one place Take advantage of their business growth data Streamline their business finances Get their businesses in the best financial shape to access credit.

Signing up and linking your bank accounts and actively using your Lidya Wallet for your business transactions, allows businesses to understand their cash flow and projected revenue in real-time from one single place. Lidya's proprietary technology will constantly analyze your transaction data to offer more credit, faster disbursements and flexible repayments (weekly/monthly), as your business gets in better shape. Adding all your bank accounts could also help in increasing your eligible loan amounts.

Sign-up Video Sign-up Video Add Bank AccountLearn moreThe Finance-on-Demand platform is now available for customers to access same-day loans. It is not a mobile application but can be accessed at www.webapp.lidya.info

All Lidya customers can directly access our new Finance-on-Demand platform at www.webapp.lidya.info. Simply sign up and follow the steps to create your account. Once done, link all your bank accounts securely, start actively using your Lidya Wallet for your business transactions and get one-click access to loan applications, with no need to submit your three months bank statement.

Sign-up Video Sign-up Video

To complete the onboarding you will need to submit: 1) Certificate of incorporation 2) CAC 2 3) CAC 7 4) BVN number

In Nigeria, it is called Registered Company Number (RCN) while some prefer to refer to it as Registration Number (RN) or RC. It was issued to your business when you registered with the Corporate Affairs Commission (CAC). If you have a CAC registration but have lost your documents, you can search your business name to find your RC number here for free https://search.cac.gov.ng/home

In Nigeria, CAC stands for the Corporate Affairs Commission, that is accountable for business registration. To proceed with your Lidya Account creation we advise you to submit the CAC document and number.

If you have forgotten your login details, choose the forgot password option on the login page to reset your password and follow the steps. The user name is the first email address you inputted to sign up.