Lydia is doing great job in helping businesses and I’m one of those that has been benefiting from the great services Lydia is rendering

Stoprite Stores

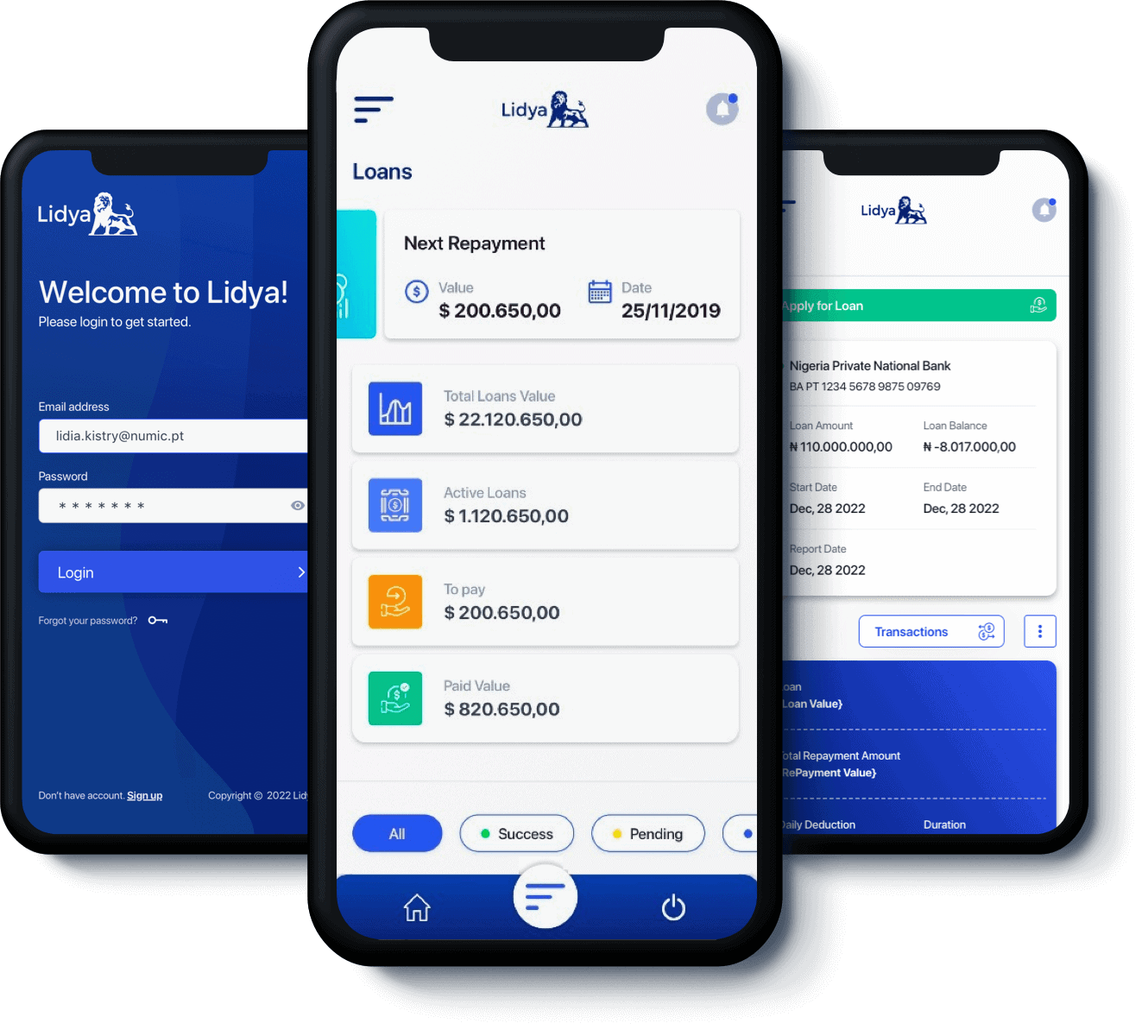

Access quick and easy loans to pay invoices, suppliers or simply invest in your life goals.

Submit your bank statements and apply to a loan instantly.

Financing to any creditworthy Nigerian, with no conditions or collateral.

Create your Lidya Webapp account.

By submitting your bank statements you can securely connect your data and simply apply for a loan.

Start enjoying your same-day loans.

Instant Application

Same-day Loan

No Paperwork

No Collateral

Real Time Access

Better Loan Terms Over-time with Lidya Score

Lydia is doing great job in helping businesses and I’m one of those that has been benefiting from the great services Lydia is rendering

Stoprite Stores

So far so good. Everything is online now. Is okay.

CHIMA UKO

Very good,and it's the best platform ever

Michael Obiene

Lydia remains the best in terms of customer services

Echeme Peter

From the 4th of July, 2022, Lidya customers can directly access our Credit Boost service on our new platform www.webapp.lidya.info Simply:

Sign up and follow the steps to creating your account

Link all your bank accounts securely

Start actively using your Lidya Wallet for your business transactions

Get one-click access to loan applications, with no need to submit your three months bank statement.

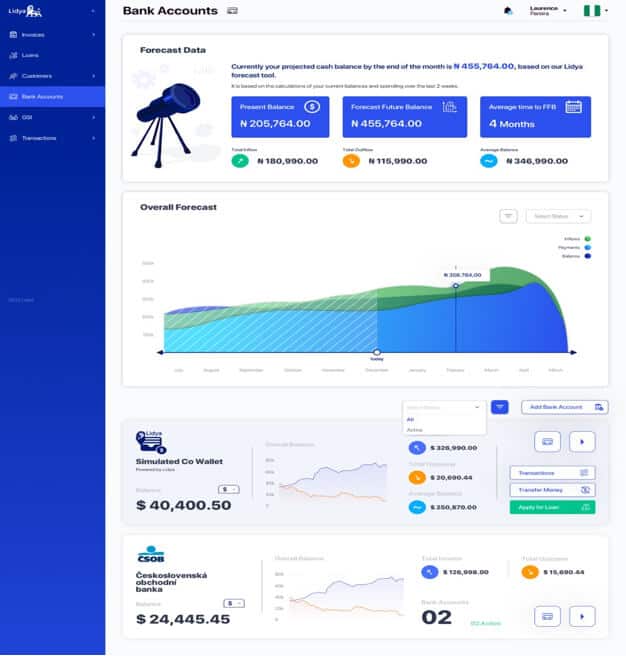

From the 4th of July, 2022, all Lidya customers can directly access our Credit Boost service on our new platform www.webapp.lidya.info Simply follow the steps to creating your account, link all your bank accounts securely, and start actively using your Lidya Wallet for your business transactions, to get one-click access to loan applications. There will be no need to submit your three months bank statement, speak with your existing agent for originations or renewals, your mandate will be automatically sent to your registered email for acceptance and your loans will be disbursed into your Lidya Wallet.

Sign-up Video Sign-up VideoFrom the 4th of July, 2022, all Lidya customers can directly access our Credit Boost service on our new platform webapp.lidya.info. Simply follow the steps to creating your account, link all your bank accounts securely, start actively using your Lidya Wallet for your business transactions and get one-click access to loan applications. There will be no need to submit your three months bank statement or speak with your existing agent for originations or renewals. Your mandate will be sent automatically to your registered email for acceptance and loans disbursed into your Lidya Wallet. Should you have issues with your applications, contact us at customers@lidya.info and an agent will reach out to support you.

From the 4th of July, 2022, all Lidya customers can directly access our Credit Boost service on our new platform www.webapp.lidya.info You will no longer be required to submit bank statements and will receive only one loan offer, based on all the analyzed accounts linked to your Lidya Wallet.

Simply follow the steps to create your account

Link all your bank accounts securely

Start actively using your Lidya Wallet for your business transactions

Get one-click access to loan applications.

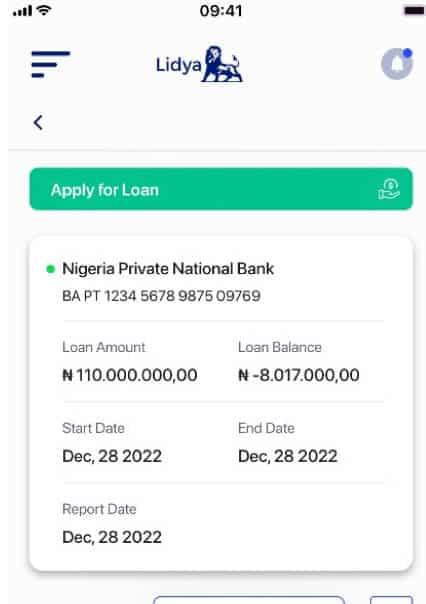

Our goal at Lidya is to provide businesses with financial tools and insights that help shape your business to become more credit eligible. Using the new Lidya Finance-on-Demand platform allows businesses to understand their cash flow and projected revenue in real-time from one single place. Ensuring you start actively using your Lidya Wallet for your business transactions and all your bank accounts are added to the platform could also help in increasing your eligibility. Once you become eligible for a loan, the "Apply for a Loan" Button will come alive and become functional to begin applying.

To know if you are eligible for a loan, you will need to start actively using your Lidya Wallet for your business transactions and link all your existing bank accounts after creating your account. Once done our technology will constantly analyze your transactions and determine the amount, tenor and flexibility of repayments that you are eligible for, making it easy to give you offers instantly.

Our goal at Lidya is to provide businesses with financial tools and insights that help shape your business to become more credit eligible. Using the new Lidya Finance-on-Demand platform allows businesses to understand their cash flow and projected revenue in real-time from one single place. Ensuring you start actively using your Lidya Wallet for your business transactions and all your bank accounts are added to the platform could also help in increasing your eligibility. Once you become eligible for a loan, the "Apply for a Loan" Button will come alive and become functional to begin applying.

To access your loan eligibility, we do regular updates of our lending portfolio data on the credit bureau for loan compliance or defaults. Once your loan with us is fully paid off (including late interest), it takes four working days for your profile to be updated with our external credit bureau partners. For additional assistance, if clearance is pending, please contact customers@lidya.info.

Make sure your account has transactions from the last 3 months, not only balance. Our algorithm needs to have proof that you have an active business.

Make sure you have balance on at least a single bank account.

Make sure your accounts have a single currency.

Make sure the currency defined in the file is valid for the country.

Make sure your Bank Statement created by website loan request is done with an unique account.

Make sure your used bank account is not already connected to another customer

Lidya uses Bank Statement Financing, which is a 30-day cash advance calculated based on the value of your 3-month transactions. This is a revolving facility that will allow you to access better offers in interest rates, tenors, flexible repayment terms and higher amounts for financing!

For example, your interest rate is 3.5% and a management fee of 2,500 per 100,000. You will pay 1,063,000 for a loan of 1,000,000.

All loans are currently being migrated to the Lidya Finance-on-Demand platform webapp.lidya.info Once our migration is complete, all customers will be able to view their loan balance in real-time. In the interim, please reach out to our customer support team via email at customers@lidya.info or your loan officer [Insert email of officer].

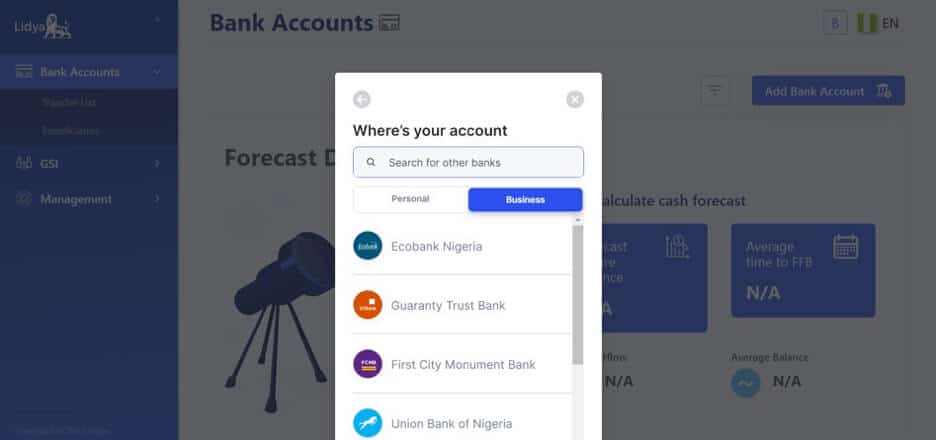

Go to the Add Bank Account button at the top right hand of the platform. Choose your access point, your mobile or Internet login, and input the corresponding details to your personal or corporate bank account to connect. Once done, your bank details, balance and transactions will be connected and displayed after your Lidya Wallet section

Sign-up Video Sign-up Video Add Bank AccountWe are working to resolve the challenges experienced in adding your bank accounts as soon as possible, in the interim, a member of our team will reach out to assist you. We want to ensure that you can access Finance-on-Demand quickly and smoothly. In the meantime, you can start actively using your Lidya Wallet and apply for a loan, here, by filling in the form.